There is an unspoken rule in DC policy circles when talking about federal social safety net programs and the undocumented community. Among advocacy organizations the story goes: quietly push for programs that don’t require a Social Security number to participate, but don’t speak openly about how these programs benefit the undocumented community. The logic being that if conservative organizations and members of Congress knew how much the community relied on these programs, the more relentless they would be in trying to end them. A very noble sentiment, but ultimately this betrays its own goals.

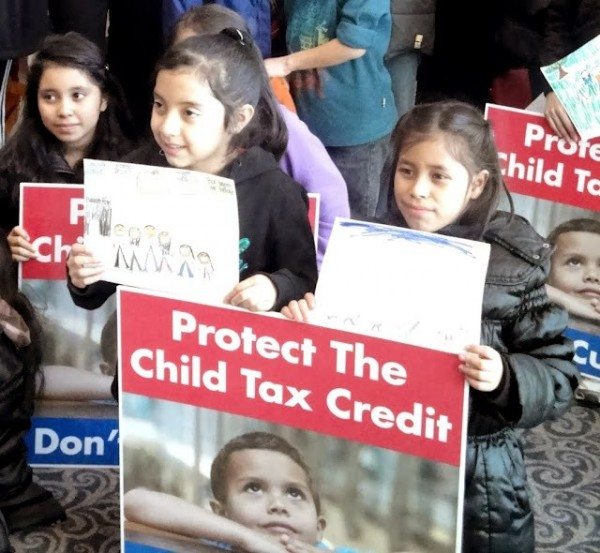

Last week the House of Representatives voted on and passed H.R. 4935, a bill that would systematically gut the Child Tax Credit (CTC) as we currently know it. The CTC is a program that helps bring children in low-income families out of poverty by providing a tax credit of up to $1,000 per child that increases as a family’s income rises. The CTC has helped lift more that three million people out of poverty.

Since its inception in 1998, the CTC has allowed undocumented parents of children in the US to apply for the program with an Individual Tax Identification Numbers (ITIN). H.R. 4935 would end this by requiring that all taxpayers use a Social Security number when claiming the CTC, effectively stripping undocumented immigrants of their chance to receive the credit.

During the vote last week in the House, both Republicans and Democrats weighed in on the changes to the CTC. As The Hill reported:

Republicans said requiring a Social Security number would prevent tax fraud. Rep. Sam Johnson (R-Texas) said the provision would discourage undocumented immigrants from trying to take advantage of the system.

“Right now the IRS is providing this refundable child tax credit to those who are here illegally,” Johnson said. “The last thing we need is to continue to encourage folks from Central America to make the dangerous and life-threatening trek to Texas.”

Democrats said the change would push children whose parents are undocumented into poverty.

“This provision will harm millions of American kids who are in the United States living in immigrant families,” said Rep. Jim McDermott (D-Wash.).

“These children and their families would be cut off from crucial tax relief if this becomes law.”

Congressional Hispanic Caucus Chairman Rubén Hinojosa (D-Texas) warned the GOP was alienating Latino voters.

“From their border recommendations to their failure to act on comprehensive immigration reform, House Republican attacks on the Latino community have persisted,” Hinojosa said. “It is time House Republicans stop these attacks and focus on what really matters — creating jobs, strengthening our economy, and ensuring the success of middle-class families.”

Needless to say, the revised CTC puts millions of documented and undocumented Latinos in a dangerous position. There are five million children of undocumented parents in this country. Four million of them are US citizens. Currently two million people use an ITIN to file for the CTC, meaning that four million children would be excluded from this benefit and potentially pushed into poverty. The children of immigrants already comprise 30 percent of all low-income families and Latinos as a whole face the highest rates of childhood poverty than any other group in this country.

We are at a point where conservative organizations and members of Congress are not only targeting undocumented folk, but also their US citizen children. Policy watchers pretty much knew that representatives would vote to gut the CTC given that every vote the House has taken up on immigration has been hostile to the community. In fact, this is not the first time conservatives have had the CTC on their target. Earlier this year, Senator Kelly Ayotte (R-NH) proposed a similar measure that would have required the children to have a Social Security number to qualify for the CTC.

However, despite the urgency of the vote last week and the continuing attacks on this program, immigrant and Latino advocacy organizations as well as from Spanish media have remained relatively quiet on the issue. Hardly a story passed online or on TV about the possible implications of the changes on the Latino community and there were no organized grassroots actions online or on the field to push back against the vote. By all measures, the vote hardly registered a blip. What is going on?

Obviously, the major announcements on administrative relief from President Obama and the refugee children have rightly taken up much of the conversation among advocates. However, the same unspoken rule of DC politics has made it difficult to have the people most affected by an issue to lead the conversation. As a child, my own family benefited from the CTC. Although my parents were undocumented, they were able to apply for the program by filing taxes through an ITIN and were able to use the extra money to keep us out of poverty. I am only one of millions of other people with the same story, but sadly these are not the stories that are brought to the forefront of the debate. Moreover, I didn’t even know that I benefited from this program until I became more immersed in DC policy circles.

It might be time to question the conventional wisdom that says we must remain quiet on programs like the CTC, and others, out of fear that they might become targets for conservatives. As we have seen, our communities are already punching bags for Republicans and Democrats in Congress and the culture of silence has left us unequipped to fight back or make sure we are leading our own fights. Over 2,000 Latinos turn 18 every day and the majority of those are the citizen children of Latino immigrants. Instead of keeping us in the dark, advocacy organizations need to find a way to center our experiences in the policy process to make sure we have the power to push back against attacks on our parents and our communities.

***

Zenen Jaimes Pérez is based in DC. You can follow him @zenenjaimes.