Tyler Duvall at a Fiscal Control Board meeting this past April. (Photo by the Centro de Periodismo Investigativo)

By Luis J. Valentín Ortiz

Versión en español aquí.

Financial consulting firm McKinsey & Co. is the lead strategic adviser to the Fiscal Control Board imposed on Puerto Rico by the U.S. government.

Through a subsidiary, McKinsey also owns Puerto Rico bonds.

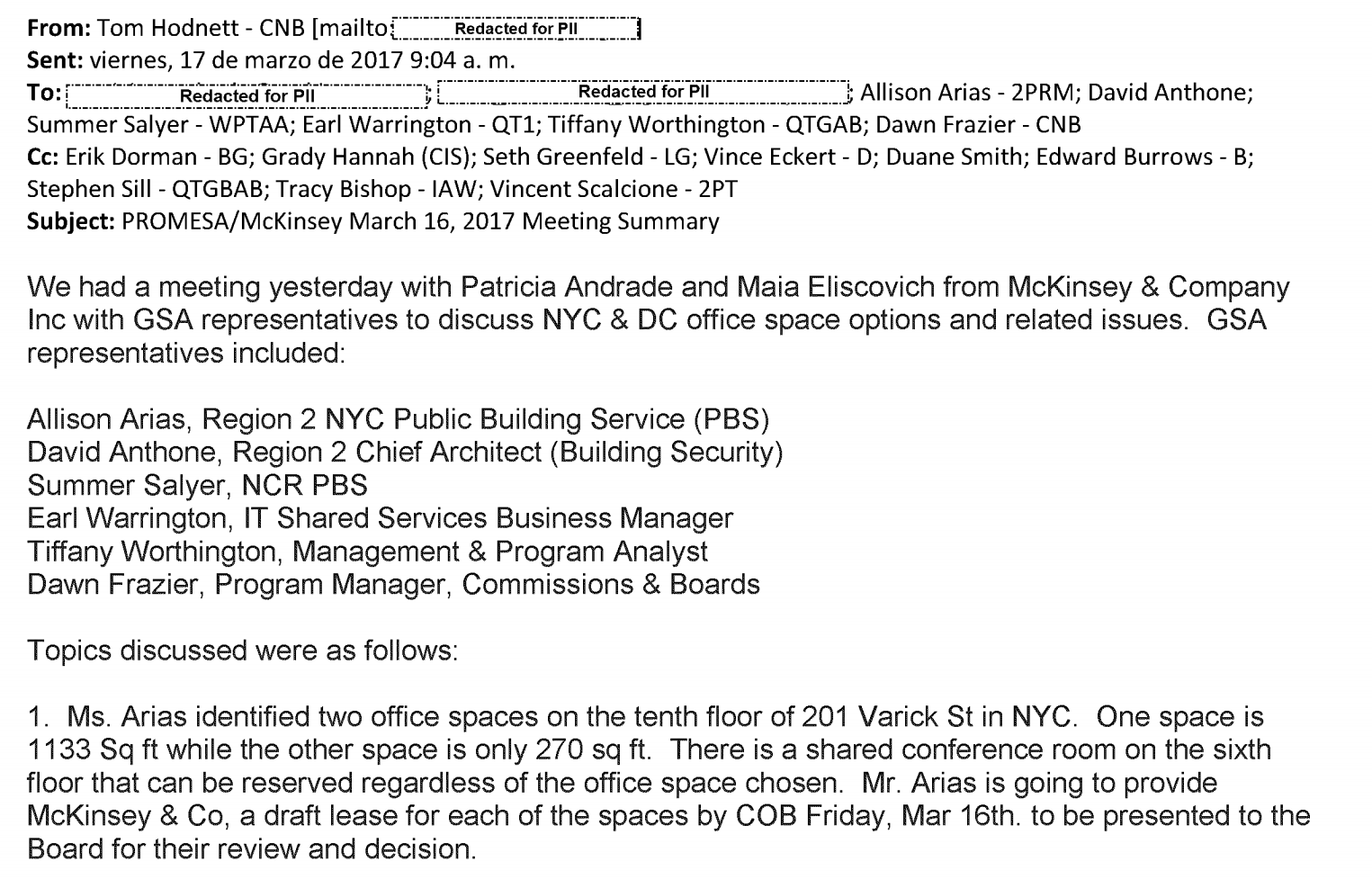

Emails obtained by the Center for Investigative Journalism (CPI) show the central role played by the multinational company in the operation of the entity created in 2016 under the federal PROMESA law. Acting as authorized representatives of the Board, some McKinsey partners interact frequently with federal government officials, discussing issues ranging from the selection of the board’s offices and activation of emails, to the privatization of the island’s Electric Power Authority (PREPA).

The firm has been key in setting up the fiscal control entity, preparing and implementing the government’s fiscal plans, and determining the future of Puerto Rico’s health, education and transportation systems, among other areas. McKinsey also advises in the island’s court-ordered bankruptcy process under Title III of PROMESA, which seeks to restructure more than $120 billion in public debt, including unfunded pensions liabilities.

While McKinsey acts as the Board’s chief strategic adviser, a subsidiary called MIO Partners (McKinsey Investment Office Partners) owns at least $20 million in Puerto Rico bonds, specifically sales tax-backed debt known as Cofina, The New York Times recently revealed. MIO Partners operates a fund that invests money from McKinsey’s partners, former employees and pension plans.

The firm also has millions of dollars invested in Whitebox Advisors, a hedge fund and one of the members of the Cofina Senior Bondholders Coalition. Since the beginning of Puerto Rico’s bankruptcy, Whitebox has been actively trading Cofina bonds, more recently increasing its total holdings to almost $170 million as of last November. Cofina is slated to become the commonwealth’s second credit to be restructured in federal court. On January 16, U.S. Judge Laura Taylor Swain will hold a confirmation hearing for the proposed plan of adjustment submitted by the Board for Cofina, which accounts for more than $17 billion of the island’s debt.

In reaction to the news that its lead adviser also owns Puerto Rico bonds, the Board launched an investigation into the matter. Its ethics adviser, Andrea Bonime-Blanc, and law firm Luskin, Stern & Eisler were tasked with the effort since the Board’s lead legal adviser, Proskauer Rose, asked to remain out of the investigation due to prior relationships with McKinsey.

The Board still expects to release by year’s end a report with the findings of the investigation, it confirmed to the CPI. Meanwhile, McKinsey continues to provide —and invoice for— its services.

The CPI asked the Board why it didn’t sideline the consulting firm until the investigation ended.

“McKinsey is a valuable consultant with expertise and experience that has greatly contributed to our work on the island. We trust that the current investigative process will provide the information required to inform any next step,” the Board said in a written statement.

Both McKinsey and the Board assured that the firm has made all required disclosures.

“McKinsey’s disclosures fully complied with all [Board] and legal requirements,” the firm told the CPI. It further argued that PROMESA does not require compliance with Rule 2014 of the Federal Bankruptcy Procedures, which calls for disclosure of any connection with the debtor, creditors and any interested party.

The Board was a bit more cautious: “We understand that PROMESA does not include Rule 2014.”

As in other cases, McKinsey denied the existence of any conflict. Although MIO Partners is a subsidiary, its work is handled independently and separately from McKinsey’s consulting business, according to the firm. “McKinsey consultants cannot direct MIO investments and do not have knowledge of MIO third party managers or specific investments. Information regarding specific investments held by MIO is not shared with McKinsey & Co.,” the firm added in a written statement.

The Board’s Code of Conduct for its contractors states that if “the Vendor does not disclose potential conflicts of interest and they are discovered by the Board, the Vendor will be barred from doing business with the Board.”

For Matt Fabian, an analyst with Municipal Market Analytics, it would be “inappropriate” if McKinsey’s financial interests are affected by the outcome of its consulting.

“At a minimum, it makes the products of McKinsey’s advice more likely to be litigated in the future,” he added.

Contractors or Employees?

With a payroll of some 20 employees, the weight of the work carried out by Puerto Rico’s Fiscal Board relies on the subcontracting of more than 20 consulting firms and law firms, most of them from the U.S. mainland. Along with Proskauer, McKinsey leads the list in terms of billing and importance of work. It represents almost a quarter ($15.4 million) of the Board’s budget for this fiscal year ($64.7 million). The latter does not include what the firm charges for its work in the Title III bankruptcy cases, which is invoiced directly to the local government and already tops about $25 million.

In all, McKinsey has made around $50 million since its retention late in 2016. Unlike the rest of the lawyers and consultants hired by the Board, the local government and the committees that represent retirees and unsecured creditors, McKinsey does not keep a record or breakdown of billed hours. It is company policy with government clients, according to McKinsey. For its Puerto Rico work, the firm charges a flat fee that has hovered around $2 million monthly.

The presence of some McKinsey employees in the Board’s work is of such degree that they are often confused as contact persons for matters related to the fiscal entity.

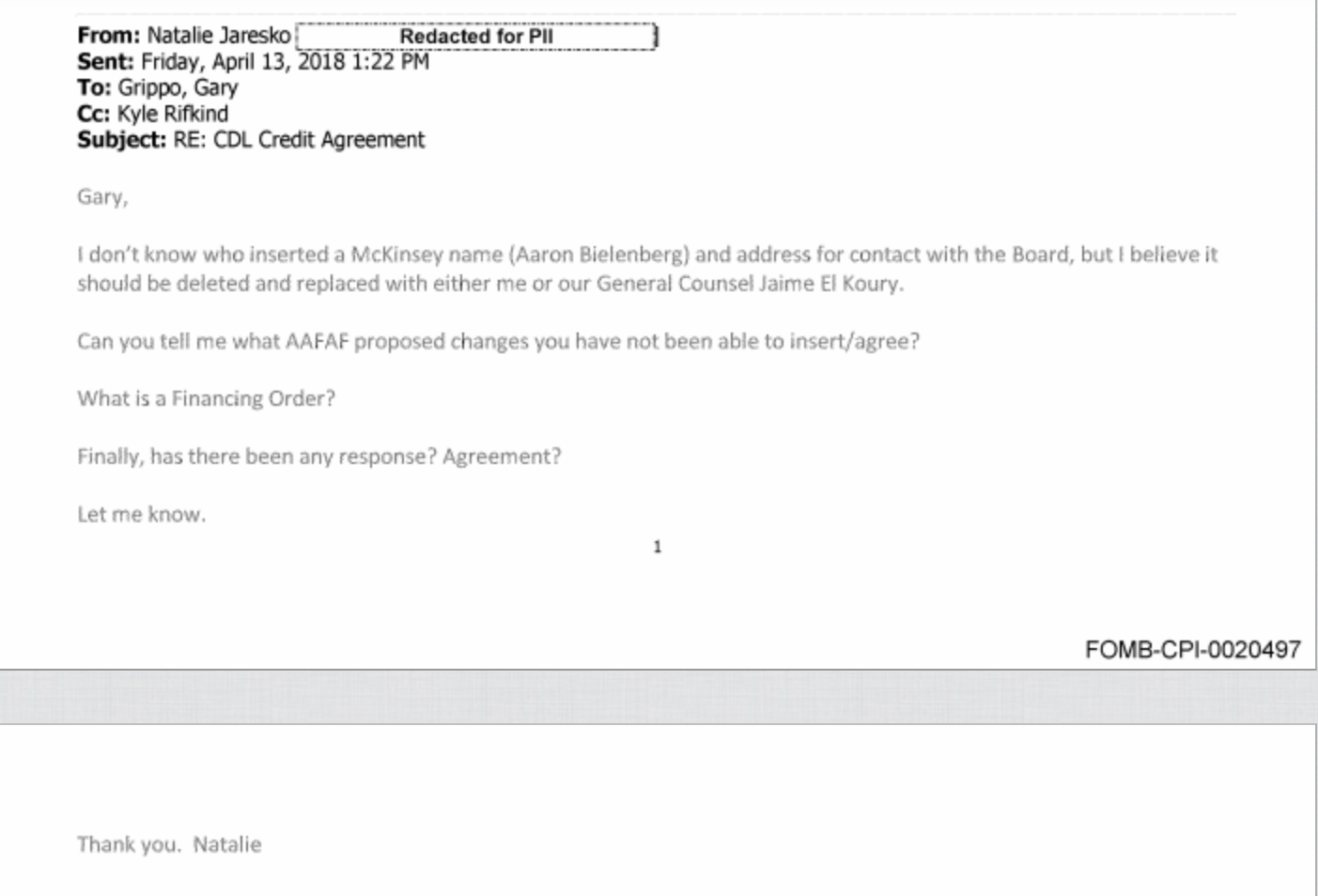

This was the case with the U.S. Department of Treasury, which initially named Aaron Bielenberg —a McKinsey employee who also acted for a few months as the first revitalization coordinator created by PROMESA— as the Board’s contact person in the agreement between the local government and the federal agency for the Community Disaster Loan (CDL) after Hurricane María.

“I don’t know who inserted a McKinsey name (Aaron Bielenberg) and address for contact with the Board, but I believe it should be deleted and replaced with either me or our General Counsel Jaime El Koury,” warned in April the Board’s executive director, Natalie Jaresko, to a Treasury official after reviewing the final CDL agreement.

On another occasion and with respect to the recovery plan after María, the Board’s deputy in-house counsel, Kyle Rifkind, replied to a meeting request made by Rima Oueid, then adviser at the U.S. Department of Energy:

“Sounds good. If it’s next week let’s do Thursday after 3pm. I’ll be in Europe on vacation so may be unable to join but Aaron from McKinsey will be on. If the week of April 9 is not too late, however, I’d prefer then because I’ll back in the office. Defer to you.”

Former Governor Alejandro García Padilla appointed Bielenberg as the first revitalization coordinator under PROMESA, in charge of pushing critical infrastructure projects under Title V of the federal law. Despite his appointment, Bielenberg never left McKinsey.

“At the direction of the FOMB, and with the approval of the Governor, the activities of the Revitalization Coordinator were to be performed by a McKinsey team member on an interim basis until such time as the Board employed a long-term Revitalization Coordinator,” the firm stated. Bielenberg’s appointment was made on November 9, but the contract with McKinsey was signed on November 27.

After nine months acting as revitalization coordinator —and without materializing any critical project— he resigned to the position, paving the way for the appointment of Noel Zamot. However, Bielenberg’s work in Puerto Rico’s fiscal crisis was far from done: from McKinsey, he led privatization efforts for PREPA and has also advised on issues related to the commonwealth’s Highways & Transportation Authority.

Tyler Duvall and Aaron Bielenberg during a Board’s meeting las April. (Photo by Juan Costa | Center for Investigative Journalism)

Around 20McKinsey employees currently advise the Board. Some of the partners that are part of the Puerto Rico team are Kevin Carmody, Sara O’Rourke, Ojas Shah, Todd Wintner, Tom Dohrmann and Bertil Chappuis, a Puerto Rican expert in the technology sector who works from the firm’s offices in Silicon Valley, California.

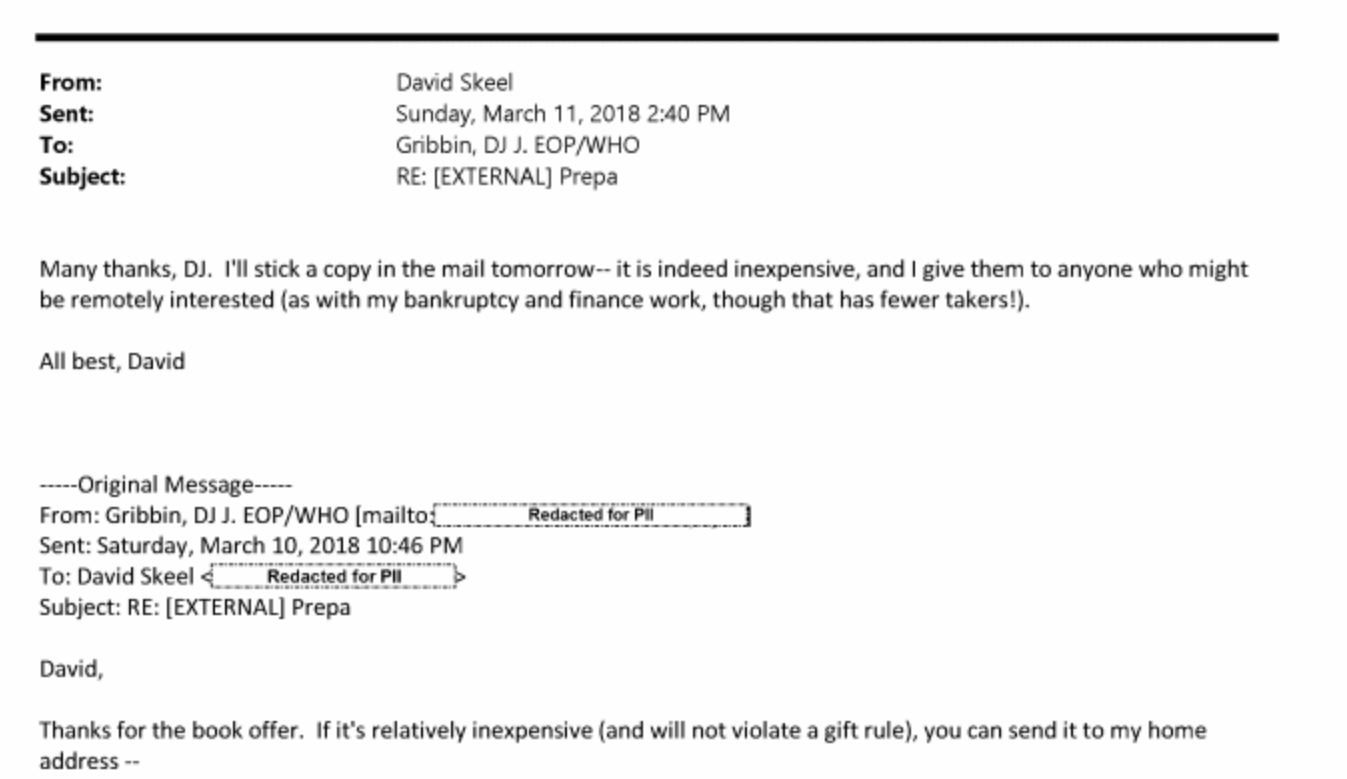

Tyler Duvall, a partner with McKinsey, leads the day-to-day relationship between the firm and the Board. A transportation expert, he was a public policy adviser at the U.S. Department of Transportation under the administration of George W. Bush. There he coincided with DJ Gribbin, who was until a few months ago the main infrastructure adviser to President Donald Trump.

In an email dated March 7, Duvall wrote to Gribbin and Kathleen Kraninger, then an adviser at the Office of Management and Budget and recently confirmed to head the Consumer Financial Protection Bureau:

“Hey Kathy and DJ, the lead board member for PREPA issues, David Skeel, was thinking of coming to town Friday and was wondering if either of you could get coffee. David is a law professor at Penn and a deep bankruptcy expert. He’s copied above.”

The meeting took place days later, according to a follow-up email by Skeel, who was grateful to “share notes on PREPA” and asked to continue the talks on a weekly basis until a fiscal plan for the bankrupt public corporation was approved. Skeel also sent him a copy of his book, A True Paradox: How Christianity Makes Sense of Our Complex World.

About a month later in April, Gribbin resigned his post. In the summer, he joined Stonepeak Infrastructure Partners, an infrastructure investment firm. In July, the commonwealth’s Public Private Partnerships (P3) Authority prequalified Stonepeak as one of the firms seeking to obtain a contract to “modernize” the island’s water meter system. Before joining the Trump administration, Gribbin worked at Macquarie Capital, where he advised on the concessions of highways PR-22 and PR-5, as well as the Luis Muñoz Marín International Airport.

Stonepeak is no longer participating of the bidding process, said Omar Marrero, director of the P3 Authority, in a written statement to the CPI.

Billion-Dollar Mathematical Mistakes

Since the first version approved in March 2017, the Board has recertified the Puerto Rico government’s fiscal plan at least five times. Some revisions respond to changes in the economic reality of the island, as happened after Hurricane María. Others follow mathematical errors that in occasions have exceeded billions of dollars.

After certifying the most recent version of the fiscal plan in October , the Board warned there was an error in the projections related to public pensions. The plan underestimates the amount that the government must pay to cover public employees’ pensions during the next 40 years. The mathematical error was $3.35 billion.

According to invoices filed in court, McKinsey has led the preparation of each version of the fiscal plan. Although these invoices show work related to pensions, both the firm and the Board denied that the error identified in October was McKinsey’s fault.

This summer, the Board also had to revise the plan following a discrepancy in population projections and healthcare expenditures. The mathematical error on this occasion totaled $4 billion. The Board did not deny nor confirm that this error was made by McKinsey.

“These are mistakes that cost millions of dollars,” said a source close to the Board’s work.

Other areas that the consulting firm has recently worked on include the elimination of labor protections under Act 80, reducing the size of the Legislature and the Judicial branch, public healthcare costs, government liquidity, collections of patents and excise taxes from foreign companies on the island, receipt of federal funds and the development of the recovery plan after Hurricane María. McKinsey also assists the Board in its annual reports, helps its members when they are questioned over the fiscal plan or budget, and prepares the letters that the Board sends to the elected government, warning government officials about noncompliance with the fiscal panel’s orders.

The firm is also responsible for following up on the implementation of the budget imposed on the Puerto Rico government, making sure it goes hand in hand with the fiscal plan. For this, the McKinsey team frequently holds meetings with officials of the Rosselló Nevares administration.

Initially, the firm took lead in the Board’s privatization efforts for the island’s power utility, as evidenced in an email sent by Executive Director Natalie Jaresko to Craig Phillips, then adviser to Treasury Secretary Steven Mnuchin.

“Ankura was the consultant [of the government] at PREPA. Now they also have Filsinger Associates. Yes, on this [the Board] used only McKinsey,” Jaresko said almost two weeks before Governor Ricardo Rosselló announced his plan to privatize the troubled public corporation. After the announcement, Citi Global Markets joined the Board’s group of advisers on this matter. The CPI learned that the Board no longer includes McKinsey on its discussions related to the privatization of PREPA.

Another public corporation whose future is in the hands of McKinsey is the Highways and Transportation Authority. Its fiscal plan calls for a change or “transformation” toward an entity based on subcontracting. It also requires increases in toll fees and identifying potential concessions for roads. This vision is consistent with what Duvall has pushed for several years as the right direction to invest in public transportation infrastructure.

Investigated in Other Bankruptcies

Flags have been previously raised over McKinsey’s lack of disclosure related to potential conflicts of interest and other disclosures required by law. Professionals who work in bankruptcy proceedings are required to disclose any connection, interest or information that could pose a potential conflict in the cases they work.

A recent example is that of Alpha Natural Resources, a Tennessee mining company that went bankrupt a few years ago. Almost two weeks ago, the U.S. Trustee filed a statement describing how McKinsey failed to disclose information related to its interests in the case, which ended more than two years ago. Part of what McKinsey did not disclose includes investments from its subsidiary, MIO Partners, in Alpha Natural Resources’ debt—a situation similar to what is happening in Puerto Rico’s bankruptcy and MIO’s investment on Cofina bonds.

McKinsey’s actions affect “public confidence in the bankruptcy process,” said the U.S. Department of Justice official, who asked to reopen the case of Alpha Natural Resources and called for the devolution of fees paid to the financial consulting firm.

Yet the strongest allegations of misconduct against McKinsey come from a direct competitor. For years, Jay Alix, founding partner of consulting firm AlixPartners, has accused McKinsey of deliberately concealing potential conflicts of interest and breaching disclosure requirements. For more than two years, AlixPartners led the restructuring advisory work for PREPA.

“Between 2001 and the present, McKinsey has knowingly and intentionally submitted false and materially misleading declarations under oath in the bankruptcy proceedings in which McKinsey & Co. and/or McKinsey RTS has been hired as a bankruptcy professional, in order to unlawfully conceal its many significant connections to ‘Interested Parties’ identified in bankruptcy proceedings and in order to avoid revealing numerous disqualifying conflicts of interest that would preclude it from being hired as a bankruptcy professional in those proceedings,” reads a civil lawsuit filed in May by Jay Alix against McKinsey under the RICO Act, a federal law against racketeering, corruption and organized crime.

The firm has denied any type of conflict, but Alix alleges that MIO and McKinsey are not separate entities.

“McKinsey, McKinsey RTS and MIO are not separate firms. McKinsey is one firm. Bankruptcy Rule 2014, therefore, requires McKinsey RTS to disclose not only its own connections, but also its affiliates’ connections, including the MIO’s connections,” reads an objection filed in court by Mar Bow Value Partners, a company owned by Alix, as part of the ongoing bankruptcy case of Westmoreland, a coal company.

In the case of Puerto Rico, both McKinsey and the Board argue that Rule 2014 does not apply to them.