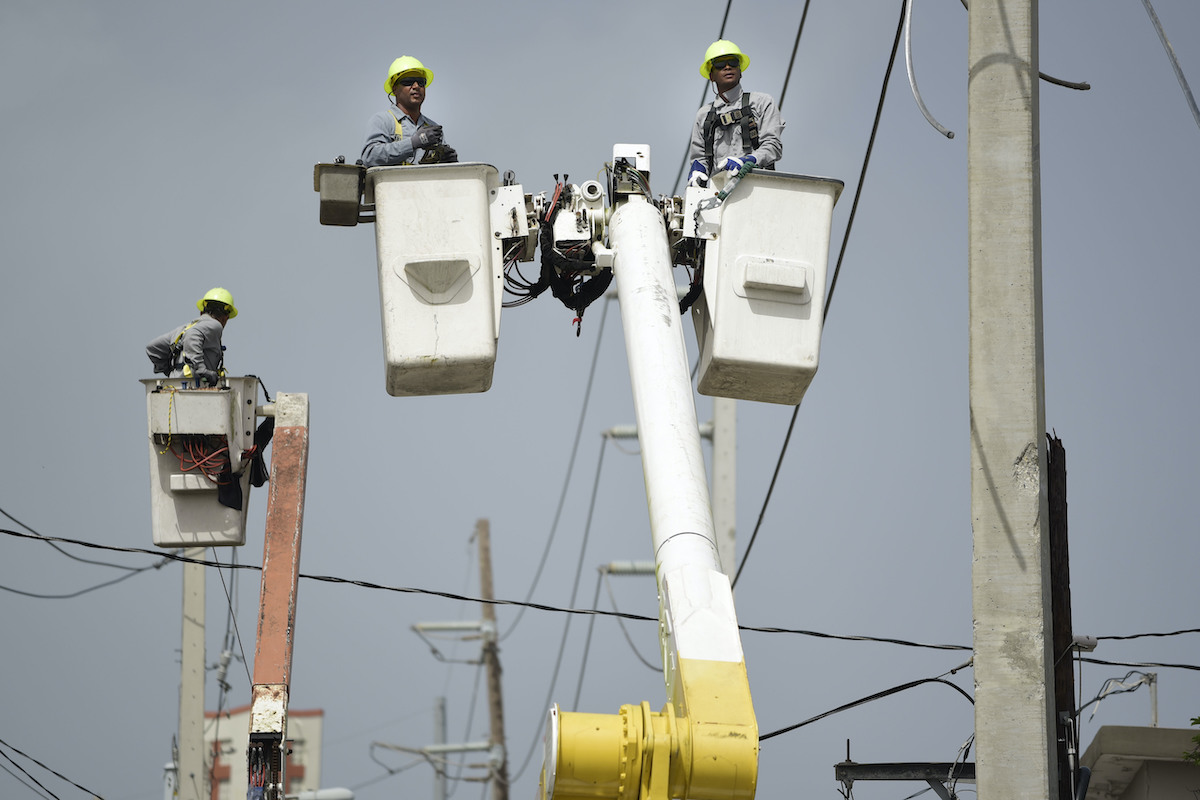

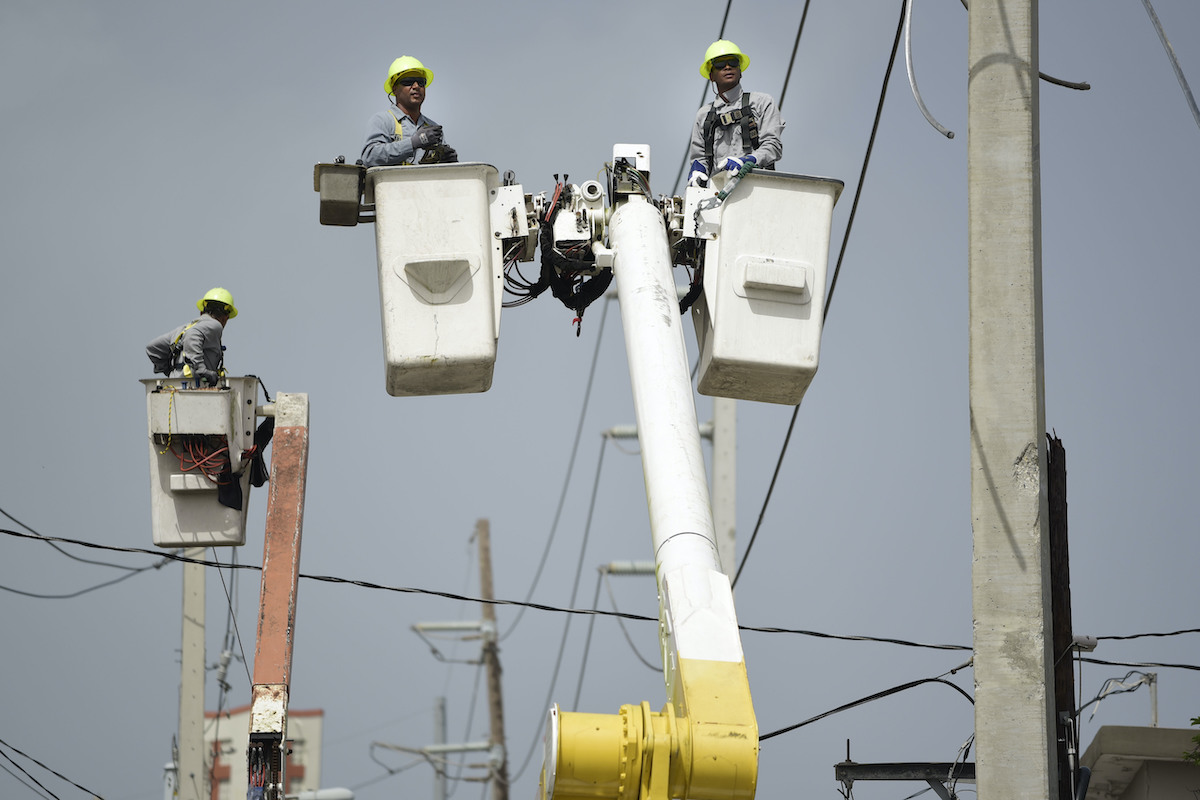

Puerto Rico Electric Power Authority workers repair distribution lines damaged by Hurricane Maria in the Cantera community of San Juan, Puerto Rico, October 19, 2017. Efforts to restructure some $9 billion in debt held by Puerto Rico’s power company hit a new snag Thursday, December 1, 2022, following multiple failed attempts to end its bankruptcy. (AP Photo/Carlos Giusti, File)

SAN JUAN — Debt restructuring efforts for the Puerto Rico Electric Power Authority’s (PREPA) $9 billion debt have come to a new standstill after almost six years of negotiation. Multiple failed attempts to exit bankruptcy have led nowhere.

All parties involved in the case had until Thursday to submit a new debt restructuring proposal for the public energy company, but the mediation team overseeing negotiations between bondholders and the Puerto Rican government has requested a one-week extension.

New York District Court Judge Laura Taylor Swain, who oversees PREPA’s debt restructuring, granted the team’s request until December 8.

PREPA’s debt is the largest held by any U.S. government agency, and its restructuring has become a key part of the Puerto Rican government’s economic development for several years. But debt negotiations for the utility have dragged on in federal courts for almost six years without any meaningful headway.

The mediation team noted that the U.S.-imposed Financial Oversight and Management Board for Puerto Rico (FOMBPR) failed to submit basic data and analysis required for ongoing negotiations, although the team noted that the FOMBPR —commonly known as “La Junta”— agreed to submit the information by Friday, December 2.

“The oversight board has cooperated and will continue to cooperate with the mediation team and mediation parties, including providing additional data within the timeframe indicated in the mediators’ report,” a spokesperson for the FOMBPR told Latino Rebels.

David Skeel, president of the FOMBPR, announced that the board had reached an agreement with the bondholders of approximately $700 million in PREPA debt for fuel lines late Thursday night. The fuel line bondholders’ request has been lowered to 16 percent through new bonds issued by PREPA on the effective date of the Debt Restructuring Plan.

“This is a great step to get PREPA out of bankruptcy,” Skeel said in a written statement. Judge Swain ordered a new round of negotiations on September 16, after the proposed debt restructuring was rejected for a third time due to a deadlock between the FOMBPR and bondholders.

“All three proposals so far, the economy could not deal with any of them,” said Tom Sanzillo, director of financial analysis for the Institute for Energy Economics and Financial Analysis (IEEFA).

A new piece was just added to the PREPA debt restructuring puzzle on Wednesday, with the government indefinitely extending its provisional contract with LUMA Energy, a private U.S.-Canadian consortium that controls much of the archipelago’s power grid, which will only be terminated if and when the PREPA debt restructuring case is concluded, at which point the government plans to sign a 15-year contract with LUMA.

The delayed PREPA negotiations and the extension of LUMA’s contract have led to many Puerto Ricans fearing that the price of electricity —already about twice the amount that people pay in the United States— will get more expensive.

Lawyer Jessica Mendez Colberg, who represents the Electrical Industry and Irrigation Workers Union‘s (UTIER) retirement system in the PREPA debt restructuring, fears the cost of these negotiations will be passed on to everyday Puerto Ricans.

“The way to pay an agreement with the bondholders will come from the revenue generated by PREPA, and where does PREPA generate money? Electricity rates,” Mendez Colberg told Latino Rebels. “We’ll probably see an increase. We just don’t know how much it will be.”

Bondholders had previously asked for a $26 monthly “connectivity charge“ per customer, which amounted to a price hike that would last 50 years and would be tied to inflation. The FOMBPR countered with a $23 monthly charge, but the negotiations fell through.

On Friday, the Citizens’ Front for the Debt Audit, Queremos Sol, and the Coalition for Energy Thought (COPE) held a press conference to condemn the proposed increase in the price of electricity announced by the FOMBPR to pay fuel-line bondholders.

“These expected increases will be disastrous, not only for people who will not be able to pay their bill, but also for merchants who will have to decide whether to pay their electricity or lay off employees,” lawyer Eva Prados Rodríguez, spokesperson for the Citizens’ Front for the Debt Audit, said during the press conference.

Throughout negotiations, bondholders have tried to get as much money as they can out of the deal, up to a recovery rate between 60 and 80 percent—a high amount for the weak Puerto Rican economy.

While bondholders could win a legal case for that much money, they still may not see an actual payout that large, as there simply isn’t enough money to pay for it, Sanzillo explained.

Should such an outcome occur, Puerto Rico might end up in another bankruptcy, he added.

“They’re continuing to pursue a strategy that’s financially impossible,” Sanzillo said.

Sanzillo argues that the money owed to bondholders should be written off as a loss to meet the debt restructuring goals if the archipelago ever sought to achieve an affordable and stable electricity supply. He agrees that bondholders should get some type of payout, but not at the expense of ratepayers.

“If you study the financials closely, you can see that the ratepayers cannot afford this legacy debt service. It doesn’t work,” Sanzillo said. “They’re going to wind up back in the same position if they come to an unrealistic conclusion and try to force it down the pipe.”

Puerto Rico exited the largest municipal bankruptcy in U.S. history earlier this year after announcing it would not be able to pay its over $70 billion public debt fueled by a mix of colonialism, corruption, and mismanagement.

PREPA is the only public utility whose debt is yet to be restructured.

***

Carlos Edill Berríos Polanco is the Caribbean correspondent for Latino Rebels, based in San Juan, Puerto Rico. Twitter: @Vaquero2XL